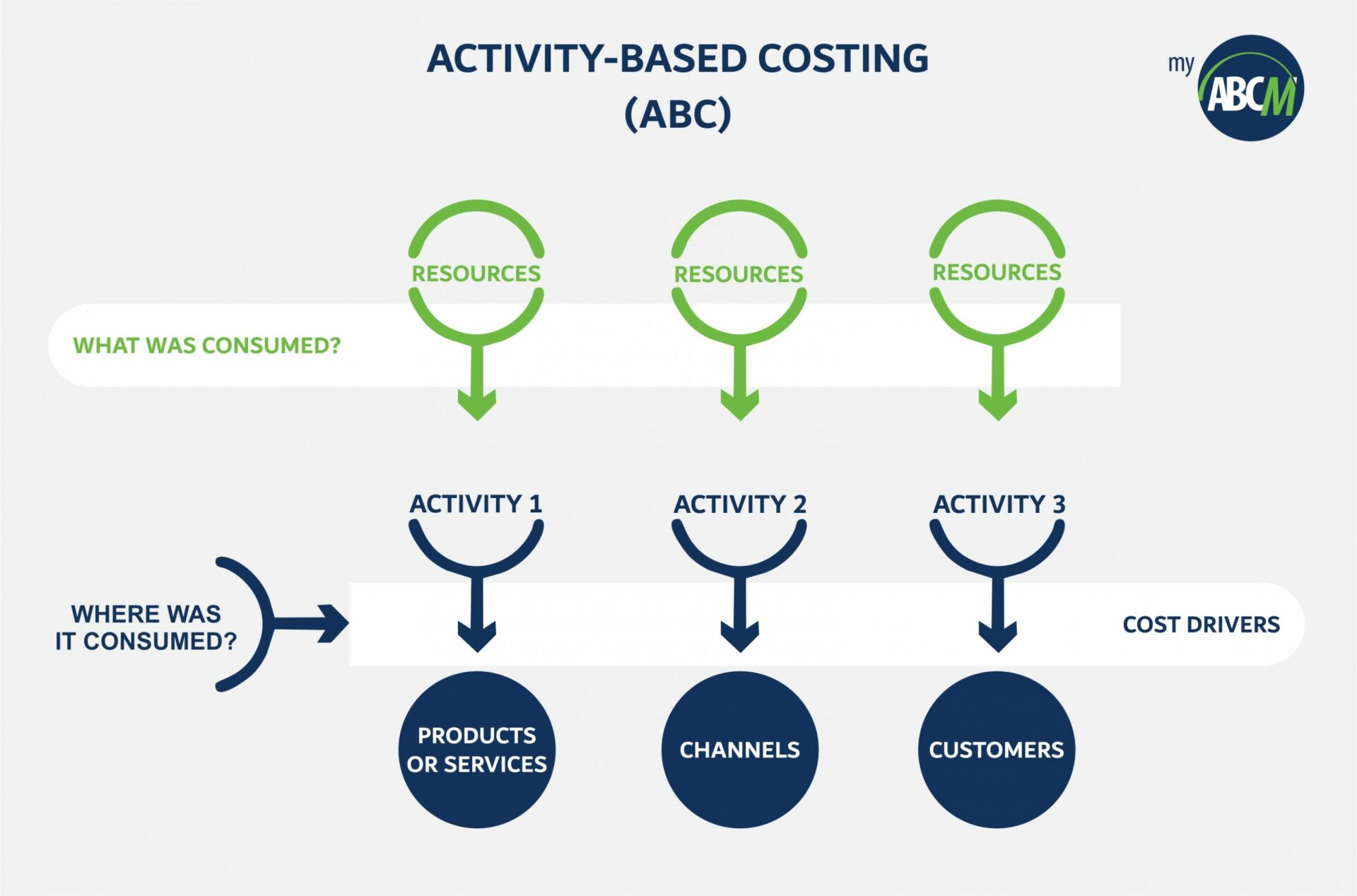

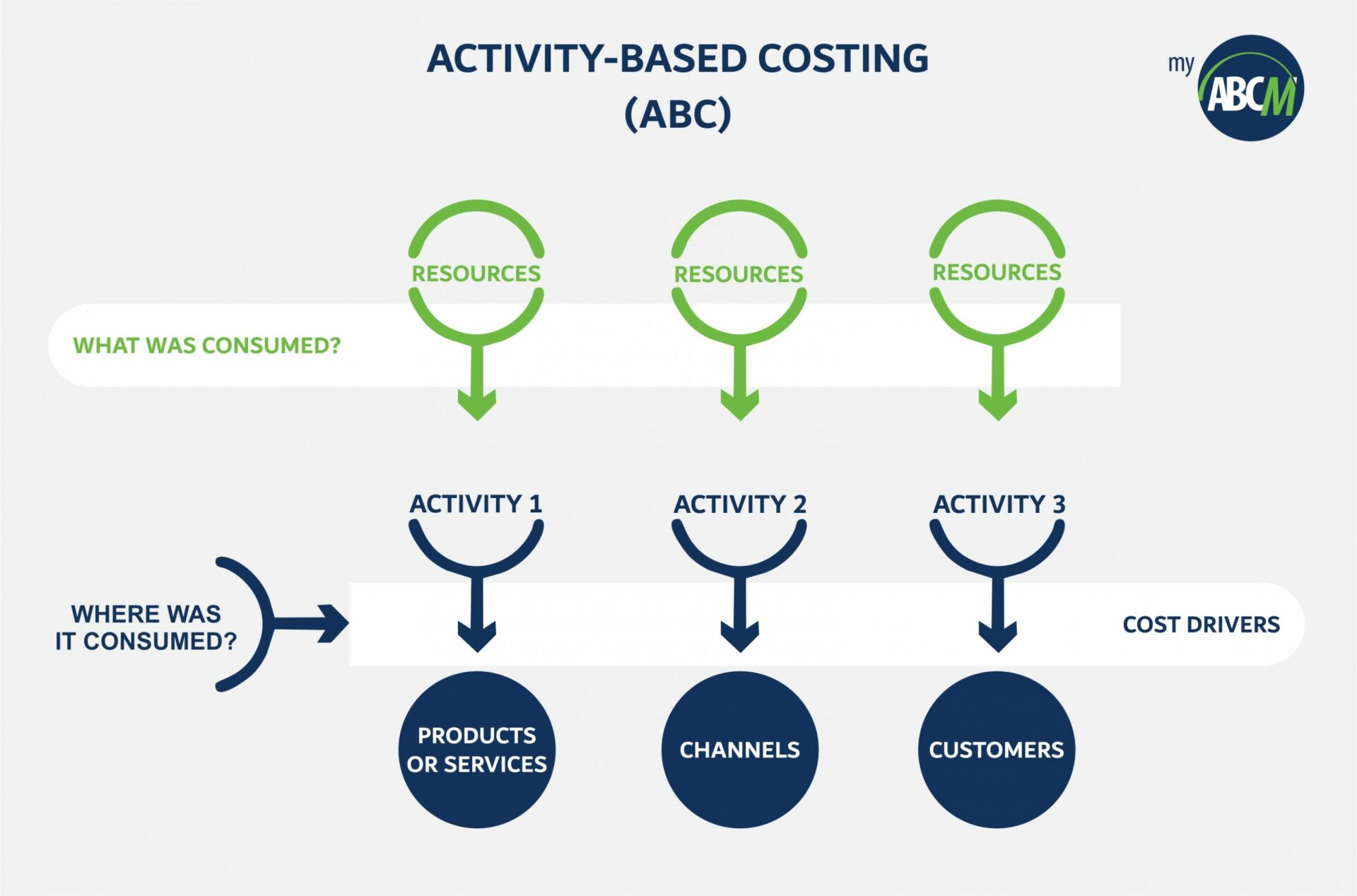

ABC costing analyzes costs related to each activity in product manufacturing or service execution. Resources are allocated based on these activities to different products, services, markets, etc., providing a clear view of the company’s costs. In this way the company gains a more precise understanding of how each activity impacts operating costs, enabling better profitability management.

Origins and development of ABC costing

Studies and documentation indicate that large US industries used some form of ABC costing in the 1950s. However, the methodology only really became known with the dissemination and popularization of the studies of Professors Robert Kaplan and Robin Cooper in the United States in the early 90s.

These two professors identified that, for several reasons that we will present later, the method used to cost the various products and services no longer reflected the reality of what occurred in organizations, causing great distortions and greatly damaging the results of companies.

In their studies, Prof. Kaplan and Cooper identified 3 independent and simultaneous factors that justified the implementation of ABC costing:

-

The change in cost structure since the 1950s

Previously, direct labor accounted for around 50% of total product costs, with materials and raw materials at 35%, and overhead at 15%.

Nowadays, overhead can reach up to 60% of product costs, with raw materials at approximately 30%, and direct labor below 10% (in Service and Government organizations, overhead is even higher).

While using direct labor hours for cost allocation might have been acceptable until the mid-20th century, it no longer makes sense in today’s cost structure.

-

Competition

The number and level of competitors have changed significantly over time. Consequently, many organizations have experienced declining margins year after year, making efficient cost control extremely important.

In this context, implementing the ABC costing methodology enhances cost control, leading to increased competitiveness and improved profit projections.

-

Falling implementation costs

The cost of implementation and measurement has significantly decreased due to the advancement and widespread accessibility of information technology. In the past, implementing an effective ABC costing system was prohibitively expensive and feasible only for companies with access to large applications running exclusively on mainframes and large computers.

As computer technologies advanced, the methodology became accessible to a broad range of organizations. Thus, the main reason why this costing system only became popular at the time of the publications of professors Kaplan and Cooper was the advance of computer resources (hardware and software). These technological advances allowed the system to move from theory to practice, especially in the implementation of cost models in more complex organizations that required greater detail.

The missing trigger for this popularization coincides with the emergence of mini and microcomputers in the late 1980s and the development of graphical software interfaces through the Windows (Microsoft), OS/2 (IBM), and Mac (Apple) operating systems.

In this way, applications that had previously been intended only for use on mainframes and large computers could be implemented in any organization, making them accessible to the various users and departments of a company.

Thus, today, many organizations have successfully used ABC costing in various segments, such as manufacturing, government, services, telecommunications, banking, logistics, etc. Its use, contrary to what many imagine, is not limited to large corporations, but can also be implemented in medium and small companies, whether public or private. Here, we’ll provide you with comprehensive information about this system, its benefits, and the implementation process. Take a look!

Differences between ABC Costing and traditional costing systems

Traditional costing systems have emerged mainly to meet tax and inventory valuation requirements. However, these systems have several flaws, especially if used as management tools.

Traditional costing methodologies focus on the company’s various products, apportioning total costs to them based on the assumption that each item/SKU consumes organization resources in proportion to the volume produced.

In this way, the various “volumetric” drivers such as a number of direct labor hours, machine hours, and raw material value are used as cost allocation criteria to settle overhead costs.

However, this approach results in figures that only reflect an average estimate. Despite the complexity of the calculation, it doesn’t precisely align with the specific characteristics and processes of each company.

These volume-based drivers also fail when dealing with diverse product shapes, sizes, and complexities. Additionally, there is no direct relationship between production volume and the efforts or costs consumed by the organization.

As a result, many managers of companies providing diversified products and services, when applying these traditional models, are making extremely wrong decisions regarding prices, product and service mix, and even processes.

The efficiency of ABC costing

Unlike traditional costing systems, activity-based costing centers on the organization’s processes and activities. It also provides special attention to often overlooked aspects in companies, such as the cost of different customers, channels, markets, and regions – essential for making accurate decisions.

In the beginning, costs from each activity are tracked within the company. Then, these costs are allocated and analyzed to determine how each activity impacts the final costs, enabling a precise assignment of expenses.

Thus, the various costs are allocated from the various activities to the various Products, Customers, Channels, etc. based on the use of these by each activity of the organization. In this way, overhead is allocated appropriately, always respecting a cause-and-effect relationship and not using “volumes” as the basic apportionment criterion.

Once the activities have been costed, the organization can begin to manage them, frequently questioning why each one is influencing or impacting the costs of the various products, customers, channels, and services in the company. With this system, the costing process becomes more accurate and precise at the same time.

Focus on activities, not products

What makes this costing model an extremely efficient methodology is something that starts with the way of thinking about cost. What was treated by other models as an indirect expense linked to a product becomes a direct expense. The focus then becomes the activities performed, not the products that come from them.

The crucial aspect lies in recognizing that each product, service, customer, or channel results from a variety of activities. Treating them individually enhances the description and conversion of their specificities into more accurate values.

The key word is traceability

The effectiveness of this costing methodology relies on its capacity to establish logical traceability for expenses. As it’s not bound by the temporality of each process, ABC costing can identify and assign each expense to a specific activity.

In this way, even if certain expenses are grouped under the same cost center, they will be organized according to the activity to which each one is linked.

This optimization of cost control delivers multiple benefits to the company across various sectors, as we’ll demonstrate below.

Advantages of using ABC costing

There are several advantages to implementing ABC costing in a company, extending beyond accurate cost definition for products, services, customers, and channels.

Below, we will describe some of the most important ones to highlight how this methodology enhances the company’s profitability and empowers managers in decision-making.

Enhanced accuracy in the information

After creating a model with studied cost allocation criteria and defined future implementations, decision-makers gain access to better and more precise information.

This improves the company’s planning and decision-making processes. Managers gain more power in forecasting future profits and expenses and have well-founded arguments for effective decision-making, including product and service pricing, product mix, outsourcing or internalization choices, research and development investments, automation, marketing, campaigns, and more!

Improved insight into process flows

In this item, we can mention not only the collection of more transparent data on expenses in each sector but also a review of internal controls and greater visibility of each process.

With comprehensive information about various processes and their impact on Products, Services, Customers, and Channels, the company can make more confident decisions. Managers gain additional tools to manage team expenses and access data for auditing and expense analysis.

With a clear understanding of activity costs, managers can base decisions on business processes and activities. Moreover, by assigning “labels” to mapped activities, they can analyze which ones add value and which ones do not, for instance.

Cost reduction

Describing the specificities and costs of each process enables a multidimensional analysis of expenses in each activity, from a global perspective to detailed visualization of each activity’s cost and its impact on profitability. This identification allows adjustments to reduce unnecessary expenses and revise planning to align with actual costs.

Achieving an increasing cost reduction, then, becomes only a matter of time, as each manager will have access to more accurate information to analyze these processes.

Additionally, it’s essential to note that the methodology’s effectiveness in controlling expenses makes it efficient for both small and large companies, regardless of their area of operation.

Implementing ABC costing in companies

The implementation of an ABC costing system may seem complicated and will vary slightly depending on the size and complexity of each company’s activities, products, and services.

But to facilitate the process and enable the implementation of the ABC methodology to be carried out effectively, you can use the steps listed below as a reference.

They apply to all sizes of companies and business models, helping to create an activity-based budget and promoting greater control over the organization’s costs and profitability.

-

Define the implementation tool for ABC costing

Sophisticated cost modeling demands a dedicated system. While some companies use spreadsheets for costing, others attempt ERP customization or believe BI can address management costing challenges.

However, the auditing and consulting company Ernst & Young (EY) does not recommend any of these options. According to EY, “Model development can be performed in Excel, Access, or even in-house development, but this can only be done for very simple models and even these simple models will present severe restrictions when more elaborate analysis is required. Not to mention specific issues of integration with existing systems, traceability, auditing of the model, and the security of the data itself.”

As for ERP implementation, we know how expensive and complicated it is to customize these systems. In addition, they provide a static and plastered view, which does not provide the flexibility required by such an implementation.

As for BI systems, these are platforms for presenting the information that already exists in the organization. But as we know, such cost modeling requires deep transformations from the point of view of allocations, including reciprocities and understanding of costs at multiple levels and dimensions, something not so easily or virtually impossible to implement in a BI.

By addressing these practical implementation issues, the MyABCM product suite stands as the global leader in managerial costing solutions. Offering multidimensional analyses, it empowers organizations to model, analyze, and simulate with great flexibility, security, and, most importantly, full integration with corporate systems.

-

Determine the objectives of the ABC costing project

It is crucial to determine the objectives of an ABC costing project. Does it aim to determine costs for Products only? What about Customers, Channels, Markets, Regions, or Projects? Defining clear project objectives is essential to avoid mid-project changes in assumptions.

Additionally, creating an implementation agenda is crucial, including defining the desired depth of the project, possible criteria, ideals, and implementation milestones.

-

Make a smart mapping of activities

Efficient implementation requires intelligent activity mapping. In such projects, managers often aim to map hundreds, thousands, and, at times, tens of thousands of activities, sometimes even at the task level.

This is an attitude of great inefficiency, since by mapping many activities, the effort will certainly be too great to result in a small benefit, especially for those activities that are not very relevant. In addition, modeling too much complexity in the first round makes the initial integration of the model with corporate systems a major challenge.

“Best practices involve modeling in stages, increasing complexity as the model evolves while considering the relevance of the mapping. As noted by Cost Management expert Gary Cokins, ‘Organizations must assess their performance in what is crucial and relevant to the business.”

-

Make a good definition of Resources

Here it is necessary to define the initial costs, expenses, cost centers, accounting accounts, possible groupings (Cost Pools) to be established, and Revenues that will be the initial Resources to be allocated.

-

Establish the various allocations

This part of the planning is important so that each Resource is linked to a process and this is identified according to its relationship with the activities linked to a product, service, customer, channel, or project.

-

Determine the drivers

After defining Resources and Activities, establish cost drivers and the criteria for their utilization.

In this way, the calculation process will make sense, as there will be a link that represents a cause-and-effect relationship between sources and their destinations.

-

Calculate the model and extract reports and analyses

Once the model is defined, it is time to calculate it, generate simple and complex cubes (which will later support the various analyzes through dynamic tables), and create a system that allows simple and advanced simulations (what-if).

By applying and analyzing reports, it is possible to evolve the system, effectively tracking an increasing number of relevant activities for the company.

In conclusion

Implementing an ABC costing system provides better control over the organization’s costs. The methodology develops precise cost tracking and allocation models, identifying values associated with each process and activity, and their impact on company profitability.

This enables an efficient activity-based management system, facilitating resource reallocation and structured cost reduction, promoting high profitability even in a highly competitive environment.

Moreover, the system empowers confident decision-making, providing secure pricing and comprehensive analysis and control of products, markets, channels, customers, etc.

Thus, its implementation culminates in greater profitability in the medium and long term, thanks to a detailed view of organizational processes and the resulting increase in the company’s competitiveness.

By considering the tips in this article, you can efficiently implement the activity-based costing methodology, leading to continuous growth for your company.

In this context, MyABCM software is specially designed to offer activity-based management, enhancing cost control and business profitability.

Hence, employing a system like MyABCM solution surpasses the activity and cost management capabilities of other software. The systems are tailored to address the specificities of businesses of all sizes, offering resource allocation in multidimensional analyses that cover all relevant company activities, adapting to various complexities, and ensuring the constant evolution of costing models.

Interested in learning more about our solutions and how ABC’s costing methodology can boost your business profitability? Fill out the form below to get in touch with our experts!